One of the more obvious relationships is between the S&P 500 index (SPX) and the Dow Jones Industrial Average ($DJI) because they generally move in the same direction. Relationships and correlations exist throughout the financial markets. That could signal a potential opportunity for a pairs trade, which aims to take advantage of the (presumably temporary) gap. But sometimes the correlation between the two related securities gets out of whack, especially to an extreme level. Pairs trading involves the simultaneous trade of two correlated securities. Some securities tend to move in the same direction, even if the percentage changes are different.

Have you ever found yourself in the middle of a “typical” market situation that suddenly didn’t feel so typical? If so, you might consider exploring one of the more sophisticated market strategies: pairs trading.

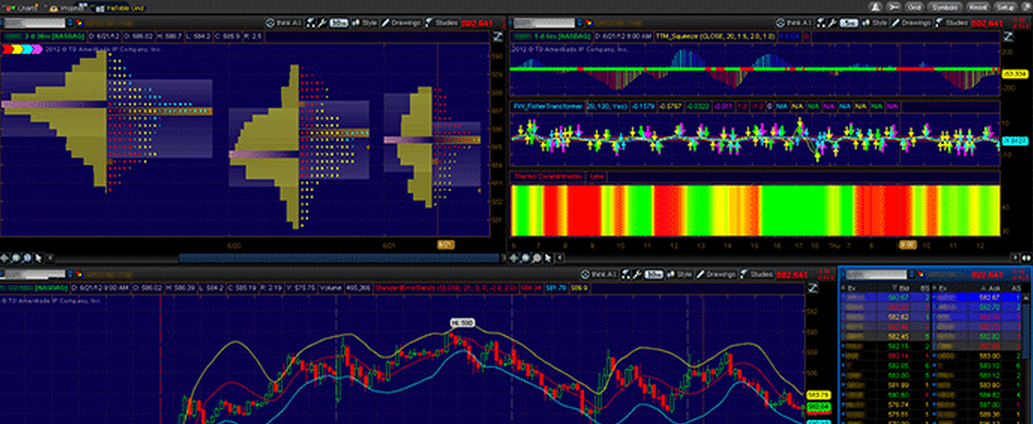

When normally strong correlations part ways, it could potentially signal a pairs trading opportunity.Know how closely a pair of stocks, indexes, or futures are correlated.Before applying pairs trading strategies, make sure you understand financial market relationships.

0 kommentar(er)

0 kommentar(er)